The Value Matrix

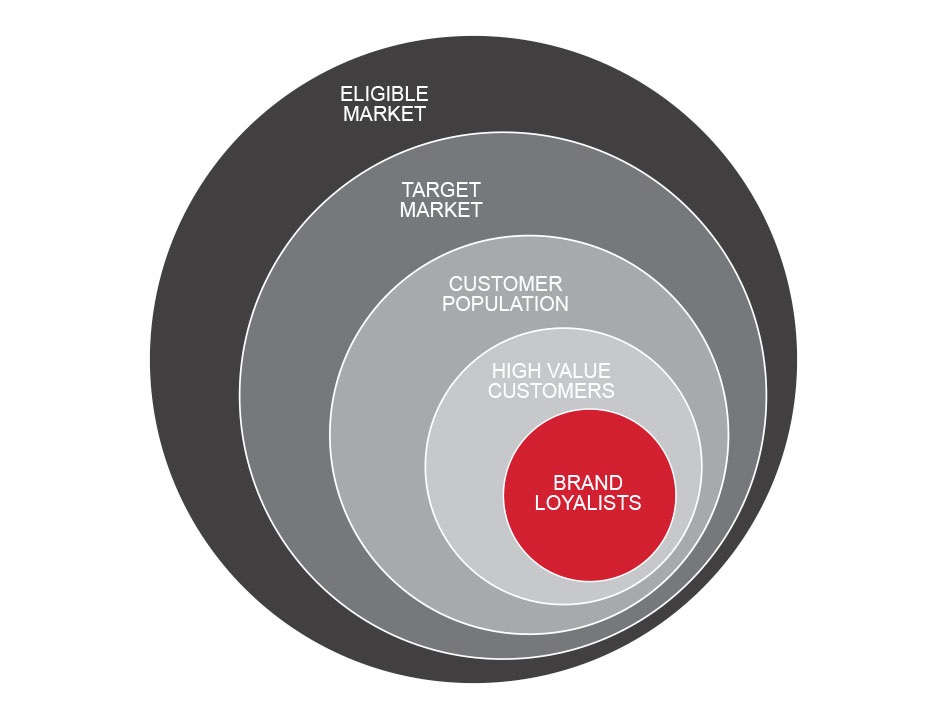

There are many ways to segment customers based on value. But to know who is truly valuable, data analysis must be combined with market segmentation and loyalty research. This triangulated view will not only inspire creative thinking – it can even be used to predict future behaviour.

It was a product so effective that its users swore by it. But the manufacturer was worried. The patent license was about to expire. A flood of generic products was expected to swarm the market. The customers were loyal – exactly how loyal was about to be tested.

How many of their long-time users would switch to the cheaper generic brands? What would be the likely revenue loss? What could be done to convince the most valuable customers to stay? In the absence of a crystal ball, the answers would have to come from some mix of research and data analysis.

The majority of end users were small independent businesses, most of them operating out of a single location. With such a large and geographically dispersed market to serve, the company’s sales team was forced to concentrate on the more lucrative multi-location businesses. That left marketing with the job of protecting the rest of the portfolio. But of the many possible countervailing strategies – price discounts, loyalty offers, a generic product of their own – which option made the most sense?

One advantage the company enjoyed was a large transaction database linked to individual businesses enrolled in a purchase rebate program. Using this database, the company could stratify firms by past spending, helping them identify the most valuable customers. But the company would have to stretch that analysis to answer a host of other questions: Did customers vary significantly in needs? Did they differ in their decision-making process? What factors made them more or less brand loyal? And importantly, how much cheaper would a competitive product have to be before a customer considered switching?

If the company answered those questions, they could start to craft a defense strategy. They could think about how to extend the value of the product beyond its functional benefits. They could introduce new value added services that would make the brand even more integral to the success of their customers. They could reposition the brand to stand for something more than simply product superiority. Or they could aggressively expand the product portfolio to cushion the inevitable fall in market share. All of those options were on the table, especially given how much revenue was at stake. But what was the best way to get the answers they needed to defend their flagship product?

True Insight

If the primary goal was to minimize flight risk, the company would have to focus its retention strategy on the best customers outside of the key accounts. These were firms whose business could not be allowed to slip away. Since true insight lies at the intersection of behaviour, motivation and intent, the analysis would have to examine the past purchase patterns of these customers, and then probe for the attitudinal factors that best explained their behaviour. Knowing why customers acted in a certain way – such as a sharp rise or fall in spending volume, a significant deviation in order frequency, or a longer-than-usual lull between purchases – might inspire a creative response to the looming crisis.

True insight lies at the intersection of behaviour, motivation and intent.

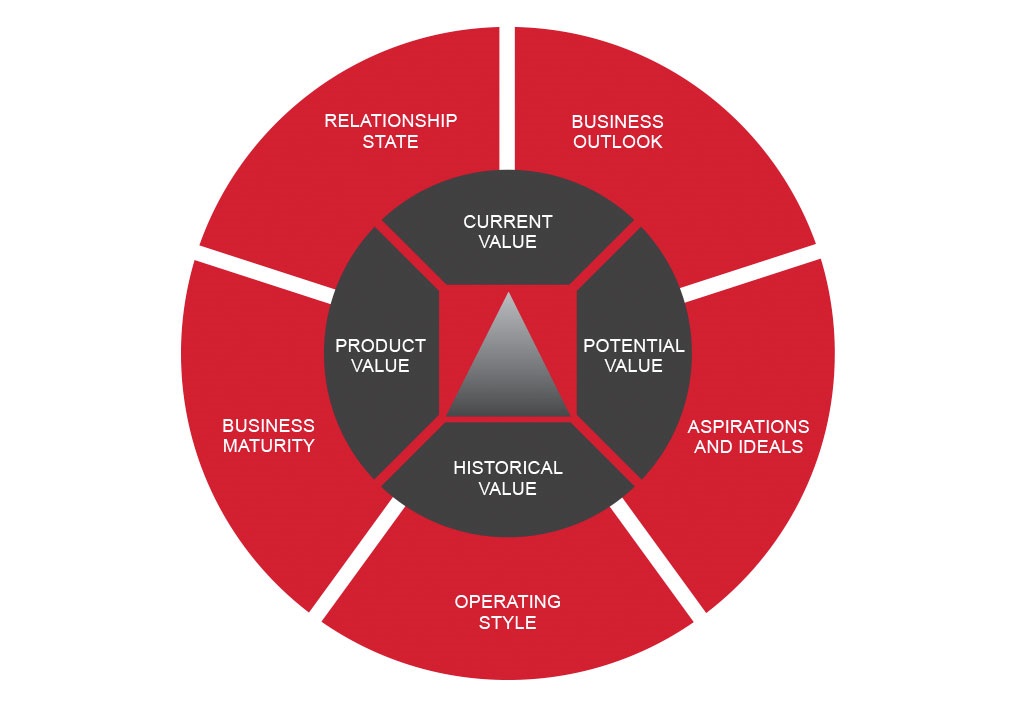

A systematic approach was needed, combining behavioural profiling, attitudinal segmentation and loyalty driver research. The analytical database would have to take the shape of a three-dimensional matrix: one side denoting customer value; another side representing attitudinal drivers; and the third side reflecting the state of the brand relationship. That way the matrix could be pivoted to identify nested segments within each value tier. More than that, the analysis would be able to estimate the potential portfolio loss due to customer attrition, helping to build the business case for retention.

Before any of this work could proceed, however, it was essential to do the proper groundwork. The company needed to understand how their customers – 80% of whom were small to medium sized businesses – preferred to operate: how they made decisions; what their ideals and aspirations were; their management acumen; their appetite for growth; how they treated employees; their business confidence and outlook; their views on supplier relationships, and more. All of that knowledge could be used to shape the segmentation study to follow. To gather this feedback a series of one-on-one discovery interviews were conducted with select customers who were representative of the market.

What the company learned was that these business owners and managers varied dramatically in entrepreneurial drive and business sophistication – not surprising, given their humble origins. However, they did share a lot in common: concern about the stagnant economy; about government regulation; about the risk of litigation; about the health, safety and training of their employees; and, of course, about keeping their customers happy. A collective picture emerged of business owners passionate about their work; heavily reliant on distributors for advice; and loyal to products, not brands. Most worrisome: none of them were averse to trying generic products if it made financial sense. As far as they were concerned, the product manufacturers were all the same. None of them had any meaningful presence in their lives – in fact, as corporate brands, they were very nearly invisible: the brand relationship did not extend beyond the box.

None of that was encouraging news to the company. It suggested they would be practically defenceless in a price war. To avoid being slowly bled to death by new market entrants they needed to change the character of their relationship with customers. They had to step out of the shadows and position themselves as fellow travellers committed to the health and progress of the industry. They also had to prove that they had the best interests of customers at heart. But that meant side stepping the distributors and reaching out directly to these companies. And it meant approaching only those customers who were most likely to value a more collaborative relationship with manufacturers. But which customers? A partial answer to that question was buried in the past five years of transaction history.

Stretegic Riddles

To avoid being slowly bled to death by new market entrant the needed to change the character if the relationship with customers.

No matter how conversant everyone is with the Pareto principle, it always comes as a shock to owners when they see how dependent their business is on so few customers. In this case, the top 20% of the customer portfolio accounted for 83% of total revenue (no surprise there). But a top decile account was worth almost seven times more than the average customer – a worrisomely high multiple. And on closer inspection almost half of the revenue from the top two deciles was being generated by just 2% of customers. Many of those elite accounts, of course, were already being served directly by the sales force. Yet mixed in with those accounts were many less important customers, diffusing the sales effort.

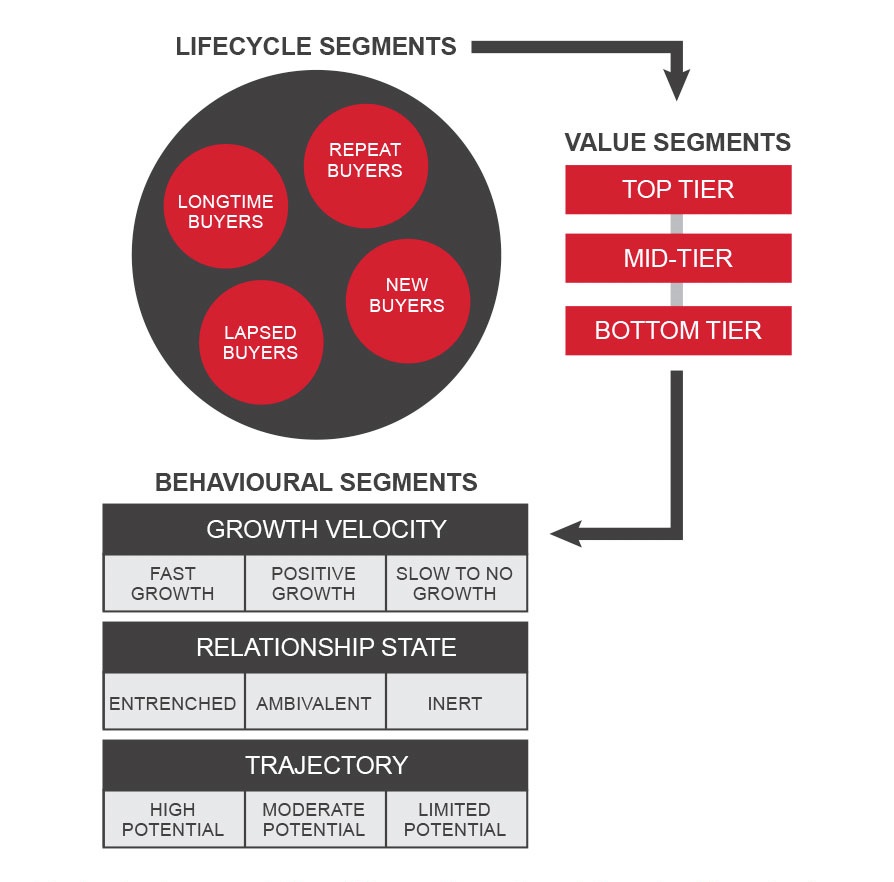

Across all of the value segments there were sub-groups of customers whose year-over-year spending growth far exceeded the rest of the portfolio. In fact, about one-fifth of the customer base had doubled their spending in the past five years. But almost two-thirds of customers had reduced their purchases, largely due to adverse market conditions. An intriguing story began to emerge: within each value tier there were significant numbers of customers whose historical spending trajectory made them highly desirable accounts to retain. Therefore, the value segmentation had to incorporate two other critical variables: relationship status (entrenched, ambivalent or inert) and spending velocity (fast-growth, moderate, flat or negative). Together these variables could be used to identify high value customers whose behaviour was suggestive of business vitality and continued growth.

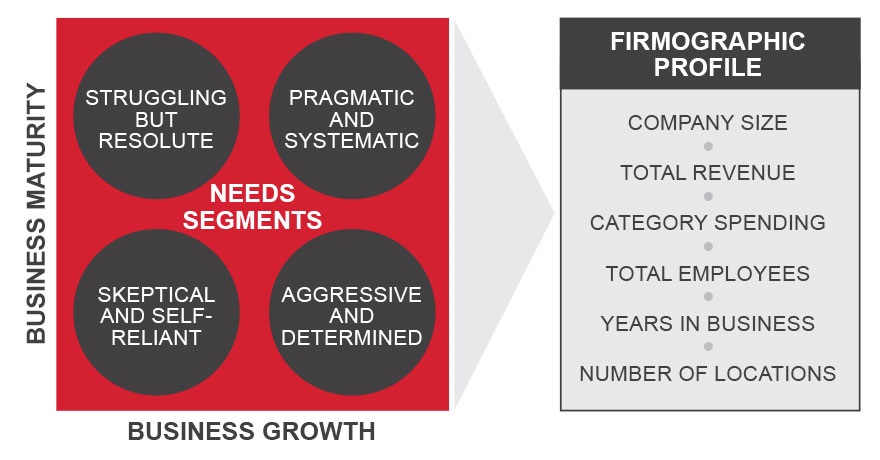

What the behavioural segmentation could not reveal was how these customers differed in their attitudes and needs from everyone else. At a time when the market was shrinking due to declining demand, how did the more successful businesses manage to thrive? And what was stopping them from growing even faster? The answer to those questions could only be revealed through a segmentation study of the entire market based primarily on two factors: growth orientation and business sophistication.

At a time when the market was shrinking due to declining demand, how did the more successful businesses manage to thrive?

Once the market segments were defined they could be mapped back to the customer base to determine the precise distribution across the value tiers. Within this value matrix, custom strategies could be devised for each segment based on their respective business drivers and management maturity. This approach would help solve a number of strategic riddles: How should they extend the value proposition to be seen as more than just another product manufacturer? What would they have to do to earn true partnership status? And what really mattered to these customers beyond the functional product benefits?

Beyond the Box

The segmentation study found that the eligible universe of companies was bifurcated: half of the target population was made up of firms in survival mode, struggling with profitability and growth, while the other half consisted of businesses which were flourishing despite the decline in overall market demand. Within the no-to-low growth market, there were two kinds of business owners: those who recognized their weaknesses and aspired to reach the next level of maturity – and a self-reliant but skeptical group of established businesses wedded to the status quo. On the high-growth side, operators could be characterized by their level of adroitness in business planning, or by their zeal for top-line sales growth. All four segments were distinct in their operating style, in their openness to new ideas and in their business savvy. At that point it was obvious which market segments were the most attractive – but the harder question was, which of them was least brand loyal?

When the company mapped these attitudinal segments to their own customer base, they found that the percent distribution mirrored the market. But when revenue contribution was factored in, one segment stood out from all the others: the business planners who kept careful control of their bottom line. In fact, that one segment accounted for half of all product sales. Clearly, these customers were critical to retain. There was just one problem: they were the most value conscious – which made them the most likely to switch if the price was right. In fact, it was estimated that more than 80% of that segment would be at risk of defecting if the price variance was greater than 20%. The implications were apocalyptic: potential revenue losses could run as high as 60%. What could be done to dissuade these customers from bolting at the first sign of a better deal?

Before proceeding with any kind of strategy, the company needed to reimagine the brand experience through the eyes of customers. To help with that exercise, personas were developed for each segment, bringing to life their hopes, dreams and ambitions, while describing their defining attitudes. The pragmatic and sensible business planners, for example, were personified as an archetype by the name of Mike. His main goals: to balance growth and cost management. He was depicted as a “calculated risk taker” always on the look-out for better and more cost-effective products. Thorough and rational in his decision style, Mike was the sort of manager who revels in intelligence gathering and trend watching – someone who would appreciate a manufacturer playing a more active role in the industry and generously providing post-sale advice and support.

With a clearer idea of what this valuable customer segment wanted, the brand manufacturer could confidently march forward with a defined game plan: justify the premium pricing of its flagship product by offering exclusive informational services which could not be easily mimicked by low-cost generic competitors. The company would not have to yield ground on price – nor would it be forced to offer loyalty inducements: it would just have to hold out a helping hand to customers seeking value beyond the box.

Stephen Shaw is the chief strategy officer of Kenna, a marketing solutions provider specializing in customer experience management. He is also the host of a regular podcast called Customer First Thinking. Stephen can be reached via e-mail at sshaw@kenna.ca