Acting on Purpose

Coming out of this pandemic the time has come for every company to take stock of the role it plays in the world and define its true social purpose. But that job cannot be left to marketing alone - it demands a top down commitment to a purpose-led vision and adoption of a new governance model that treats all stakeholders fairly

It has been called the “Great Reset”: the opportunity for humankind to do things differently in a post-pandemic world. Businesses are now expected to do their part in reshaping society – to be a “force for good”. But first they have to ask themselves a basic question: Just how far should they go in improving the lives of people?

In the past, the answer would have stopped at “wealth creation”. But most people now concede that the single-minded pursuit of profitable growth does nothing to fix the systemic problems facing society – in fact, it may even undermine the quest for a more sustainable future. The vision should be broader and more inclusive with the nobler aim of advancing the human condition.

A purpose-led vision can guide a company through times of extreme uncertainty by serving as a stabilizing force: the vision never changes – just the path to get there. But more than that, it can help to restore public trust in business now that the pandemic has exposed the deep contradictions in society, where a new billionaire is minted every day1, while ordinary people are having a tough time making ends meet.

A meaningful purpose statement needs to be crafted with the same diligence as a constitution and the fervour of a manifesto.

Without a strong moral compass, companies are free to act like pariahs, doing anything they please. When people see corporate bosses rewarded with excessive bonuses in the middle of a pandemic (defending their exorbitant pay by saying, “we should be paid what we’re worth”) – when they hear of global corporations paying zero taxes despite record earnings – when they learn that some large profitable companies padded their earnings using government wage subsidies – when they listen to reports of big business objecting to a modest increase in corporate tax rates that would put people back to work – they feel betrayed. Each fresh revelation of corporate wrongdoing – from Wells Fargo to Purdue Pharma to Goldman Sachs, all fined last year in the tens of millions of dollars for corrupt practices2 – deepens the level of mistrust.

The public has always had a wary relationship with big corporations, going back to the Gilded Age, when industrial magnates were known as “Robber Barons” for their unscrupulous business practices. Their companies grew into conglomerates so immense, so monopolistic, that they eventually had to be broken up by antitrust action. But even in the mid-20th century, when companies were finally being run by professional managers instead of autocratic owners, corporations behaved as if they were above the law, using their lobbying clout to bend the will of government. It was left to consumer activists like Ralph Nader to protect the public interest and crusade for stronger safeguards against wilful corporate negligence.

From the 1980s onward, the Ayn Rand philosophy of unfettered self-interest was adopted as boardroom dogma and corporations abandoned any pretense of a social contract. Hard won labour benefits were whittled away – a gig workforce was favoured over salaried employees – high-paying manufacturing jobs were offloaded to low-wage countries – and working life became more precarious for everyone. CEOs went from earning 20 times the pay of an average worker to 300 times, making in a few days what the average worker earns in a year.

In the aftermath of the Great Recession in 2008 the combination of slow job growth and wage stagnation inflamed social ills. And now, in this current K-shaped economy, the wealth gap is much more acute, where the greatest sacrifices are being made by the most vulnerable. Food insecurity is rampant – people are struggling to keep up with bill payments – many households are flirting with insolvency. Meanwhile, stock prices keep climbing, fuelled by an endless surge of investment capital.

So, before their purpose statements can ever be taken seriously, corporations must give up their “win at all costs” mindset. After decades of treating the consequences of their actions as someone else’s problem, a carefully worded statement of good intentions is unlikely to be very convincing, seen as “virtue signaling”, “woke capitalism”, “greenwashing”, or just empty rhetoric, rather than a heartfelt sentiment. Which is why the job of defining purpose cannot be left to marketing or it will come across as a public relations ploy – ending with a hyperbolic press release and a pretty wall poster.

A meaningful purpose statement needs to be crafted with the same diligence as a constitution and the fervour of a manifesto. It has to be inspiring. It needs to be championed by corporate leadership. It needs to be brought to life with an activation plan. And it needs the company shareholders to give it their unconditional blessing.

The Common Good

Even the plutocracy recognizes the threat to social cohesion unless corporations become more accountable. In a now-famous proclamation that shocked Wall Street three years ago, Larry Fink, the chief of Blackrock, the world’s largest investor, issued a written warning to CEOs: either they made more of an effort to help society, or they might be denied the support of his firm. “To prosper over time,” he wrote, “every company must not only deliver financial performance, but also show how it makes a positive contribution to society”. In his most recent annual letter to CEOs he said: “As we move forward from the pandemic, facing tremendous economic pain and inequality, we need companies to embrace a form of capitalism that recognizes and serves all their stakeholders.”

Total Shareholder Return suddenly became the only metric that mattered.

Similarly, in his recent annual letter to shareholders, Jamie Dimon, the CEO of JP Morgan Chase, which enjoyed a record year in 2020, had this to say: “Shareholder value can be built only if you maintain a healthy and vibrant company, which means doing a good job taking care of your customers, employees and communities. Conversely, how can you have a healthy company if you neglect any of these stakeholders?”. He goes on to state: “Businesses must earn the trust of companies and communities by acting ethically and morally”. The fact that he had to remind shareholders that morality was important just goes to show +how out of touch they must be with the mood of the public.

Those words, spoken just 10 years ago, would have been shouted down by the investor class as blasphemous. But in these unprecedented times, coming from two of the preeminent capitalists in the world, they are now conventional wisdom, thanks to a reform movement that began around a decade ago calling for a more altruistic form of capitalism.

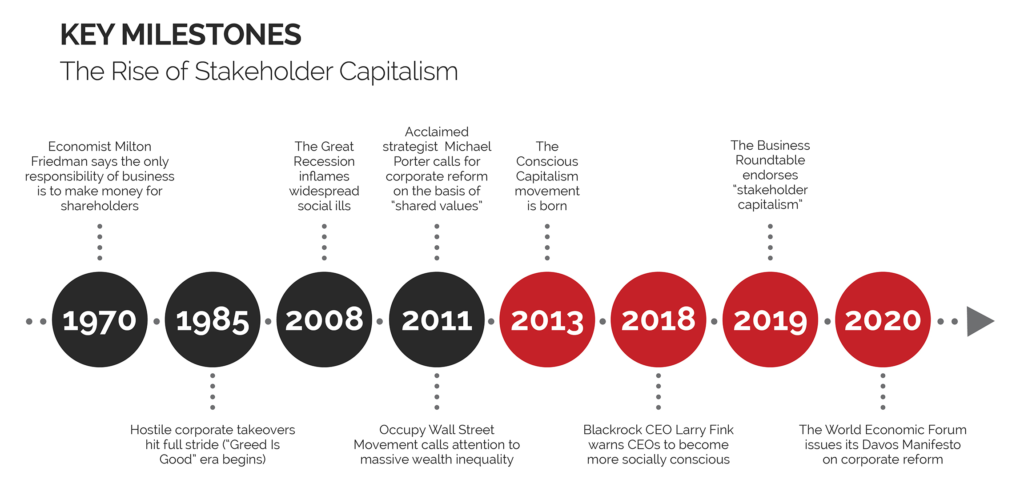

Stakeholder capitalism, as it has come to be known, is a total repudiation of the “Greed Is Good” era. Until recently the doctrine of shareholder value had been an article of faith in every corporate boardroom. It was first advanced in 1970 by the neoliberal economist Milton Friedman in a landmark New York Times essay called, “The Social Responsibility of Business Is to Increase Its Profits”. All that should matter in running a business, Friedman decreed, is the pursuit of maximum profit, calling CEOs who think otherwise “unwitting puppets” of the “intellectual forces undermining free society”. Corporate social responsibility is akin to socialism, he groused, just a distraction from the real purpose of a business, to enrich its owners.

The corporate elite now had all the justification they needed to ignore the common good. Total Shareholder Return soon became the only metric that mattered. Executive compensation was tied to stock options as an incentive for management to maximize short-term gain even at the expense of other stakeholders. Corporate management redeployed surplus cash to buy back stocks and boost the share price – money that might otherwise have been reinvested in job creation. The quarterly earning report became the CEO report card, with activist investors grading it, while hedge funds scooped up “undervalued” businesses in order to restructure and sell them.

Thus began the unraveling of the “affluent society”. Over the last four decades, a massive transfer of wealth occurred between the upper and lower echelons of society. Despite a 70% gain in productivity, hourly wages increased just 12%. The top 1% of households increased their share of wealth by one third, while the bottom half saw their part cut in half3. The ensuing social blight – the vanishing middle class – the extra hardships imposed on the working poor – the growing “deaths of despair” – eventually became so untenable that it gave rise in 2011 to the “Occupy Wall Street” movement which placed the blame squarely on what it called “pathological” corporations. But it also led to dissension in the ranks of more progressive thinking corporate leaders who were so appalled by the irreparable harm being done that they began to agitate for a reimagining of capitalism.

A New Kind of Capitalism

The first acclaimed management strategist to challenge the Friedman model of shareholder primacy was Michael Porter who in a widely hailed Harvard Business Review article in 2011 wrote, “Profits involving a social purpose represent a higher form of capitalism, one that creates a positive cycle of company and community prosperity”. The purpose of a corporation, Porter stressed, must be to create “shared value”, which “involves creating economic value in a way that also creates value for society by addressing its needs and challenges”. In short, corporations had a duty to be mindful of their social obligations, not just make a profit for its owners, a direct rebuttal of Friedman’s belief that corporate managers were “agents” acting solely on half of the shareholders.

We’re going to see a new kind of capitalism—and it won’t be the Milton Friedman capitalism, that is, just about making money. – Marc Benioff (CEO, SalesForce)

Porter’s call for an end to shareholder primacy was joined in subsequent years by a highly accomplished group of reform-minded business founders and executives. Corporate chiefs like Whole Foods founder John Mackey urged his peers to embrace a new credo he called “conscious capitalism”. SalesForce CEO Marc Benioff famously declared that, “Capitalism, as we know it, is dead”, predicting, “We’re going to see a new kind of capitalism—and it won’t be the Milton Friedman capitalism, that is, just about making money”. Klaus Schwab, founder of the World Economic Forum, who is credited with coining the term “stakeholder capitalism” in 1971, defined a company’s purpose as the creation of long-term value for society at large, taking his cue from the Nordic model of social solidarity.

The official seal of approval for stakeholder capitalism came in in 2019 when the Business Roundtable, an elite cabal of the largest corporations in the world, released a revised “Statement on the Purpose of a Corporation.” Signed by 181 CEOs, the new statement retracted its previous endorsement made almost a quarter century earlier of the Friedman model. “Each of our stakeholders is essential”, the Statement emphasized, “We commit to deliver value to all of them”.

At the Annual Davos World Economic Summit in 2020, attended by corporate moguls from around the globe, a Manifesto was agreed to, declaring that “A company is more than an economic unit generating wealth. It fulfils human and societal aspirations as part of the broader social system. Performance must be measured not only on the return to shareholders, but also on how it achieves its environmental, social and good governance objectives.”

Even Fortune Magazine, that venerable voice of capitalism, acknowledged in a recent issue devoted to corporate accountability that change is overdue, calling on business to meet higher ethical standards: “As far as society is concerned—as far as a company’s customers, employees, and even investors are concerned—how a company behaves in the world is now as important as what it sells or produces”.4

Creating Genuine Value

As calls for corporate reform escalated, marketing influencers began beating the drum for change as well, coming at it from a slightly different angle. Their perspective is similar to management guru Pete Drucker’s advice from long ago: “To satisfy the customer is the mission and purpose of every business.” Making money is only possible, they reason, if companies create genuine value for customers, not simply look for ways to increase efficiency.

Marketers struggle to elevate purpose from a messaging strategy to a company-wide set of operating principles.

In 2010 one of the world’s leading management thinkers Roger Martin published an article in the Harvard Business Review called “The Age of Customer Capitalism” in which he argued that businesses do better when they put customers first, calling the deification of shareholder value a “tragically flawed premise”. A smarter “optimization formula”, he suggested, is determining what customers value and “focusing on always pleasing them”.

In that same year Simon Sinek gained fame with his viral Ted Talk “The Golden Circle” in which he posited that people don’t buy what companies do, they buy why they do it. His mantra “Start with Why” became a war cry for many marketers. “Why” is what inspires people, he said – “why” is the reason people would miss the company if it disappeared – “why” gives work a higher order of meaning.

Phil Kotler, the “Father of Modern Marketing”, called for a socially responsible approach to business, where the focus is on creating a better world – what he called the “4Ws”: Wealth, Wellness, Well-being, Wisdom. The job of marketing, he said, is to link the needs of customers and society with the commercial needs of the business. “Marketing’s job today is to sell materialism and consumption. Tomorrow’s marketing will be markedly different.”

Jim Stengel, the former CMO of Proctor & Gamble, proved in his 2011 book “Grow” that brands which improve people’s lives grow three times faster than competitors, and outperform the market by a wide margin, basing his conclusions on a Millward Brown study of company performance over a 10-year period. Countless other research findings since then have confirmed his thesis that companies with strong brand ideals – who are clear in what they stand for and why they exist – who put the needs of customers first, and share their values – do much better than those that don’t.

These days the concept of brand purpose has gone mainstream. Yet in spite of a growing stack of literature on the subject, an expanding network of advocacy groups, and a cottage industry that has sprung up to help companies get it right, marketers struggle to elevate purpose from a messaging strategy to a company-wide set of operating principles. Which is why brand purpose needs the involvement of senior leadership, with the CEO cheering them on.

Paragons of Purpose

The companies that do get it right consistently top the charts in every measure of brand health, such as trust, reputation, loyalty and credibility. One of the first companies to prove that purpose can pay off is Unilever, the giant packaged goods company whose portfolio of brands dominate their respective categories, such as Dove, Ben & Jerry’s, Lipton, Hellmann’s and others. Its purpose statement: To Make Sustainable Living Commonplace. Select brands are given license to improve health and wellbeing as well as champion a social cause related to their category.

According to the company, its 28 “Sustainable Living Brands” have grown 69% faster than the rest of the product portfolio. The CEO Alan Jope has said, “We have extremely strong data on the link between purposeful communication and short and long-term growth”. To showcase its commitment to social progress, Unilever has even built a dedicated marketing platform called “Every Day, U Does Good.”

Philanthropy is not the same as making good citizenship an intrinsic part of corporate purpose.

Dove is Unilever’s star example of a purpose-led brand. By taking the lead on the issue of women’s lack of self-esteem, Dove succeeded in reaching the pinnacle of brand purpose by creating a self-sustaining movement. Dove’s Campaign for Real Beauty struck an emotional chord with women who felt they did not measure up to the media depiction of beauty, fostering a public discussion that continues to this day. Dove is now Unilever’s largest brand, the beneficiary of all that spillover talk.

Proctor & Gamble is another packaged goods company that has pledged to be a responsible corporate citizen, taking an unequivocal stand on issues of racial justice and gender bias, and flexing its massive media muscles to get the message out with award-winning video content, storytelling platforms, TV campaigns, and social media. All of the brand teams are expected to own a specific societal challenge which they must bake into their strategies, aligned with the P&G purpose of “making each day a little bit better for people, families and communities around the globe”.

A global brand that companies have leaned on heavily during the pandemic is Cisco, the leading provider of networking and collaboration technology, and well respected for its “walk the talk” commitment to humanitarian causes. In June of last year, the CEO Chuck Robbins announced a new mission statement, “Power an Inclusive Future for All”, explaining that, “We know our responsibilities don’t end with technology. It’s now about making the world we envision possible”. The company is dedicated to four main social goals: helping the underprivileged segments of society; extending care to families and their surrounding communities; accelerating healthcare innovation through technology; and enabling educational and healthcare institutions to adapt more quickly to change.

Here in Canada the communications technology giant TELUS is on a similar mission, stating that its “longstanding commitment to putting our customers first fuels every aspect of our business”. Its long-time CEO Darren Entwistle is a true believer in what TELUS calls “social capitalism”, saying “it is important that we lead by example and action”. His advice to other companies is to “leverage your core business to improve the social, economic or educational outcomes of your community”. That’s exactly what TELUS has done in setting up a $100 million social impact investment fund for socially conscious start-up businesses; in starting up a new agricultural business to improve the food system through technology; in creating an IT company to transform the healthcare system; and in devising a series of community-based programs to give disadvantaged Canadians equal access to technology.

These four corporations are exemplary models of acting on purpose, simply because the impetus for change came directly from the top. While many corporations have opened up their wallets for COVID-19 relief aid, philanthropy is not the same as making good citizenship an intrinsic part of corporate purpose. The real test is whether publicly traded corporations are prepared to put purpose ahead of profits. There are very few brands like the activist apparel company Patagonia willing to say “we’re in business to save our home planet”.

So how do companies make that trade-off? How far do they go? How do CEOs convince their boards that the future health of the business means giving up the sugar high of short-term boosts in share price in exchange for steadier long-term gains? And how do they even decide which social causes to throw their weight behind?

Purpose Planks

The starting point is to connect how the brand creates value for customers – what it does better than anyone – with how it can make the most meaningful impact on society at large. That is not a marketing exercise – it is the job of executive management. Marketing can clarify what value really means in the minds of customers – it can reach out to customers to get their perspective on how things should ideally work. But it is up to corporate leadership to pick the right social causes to pursue.

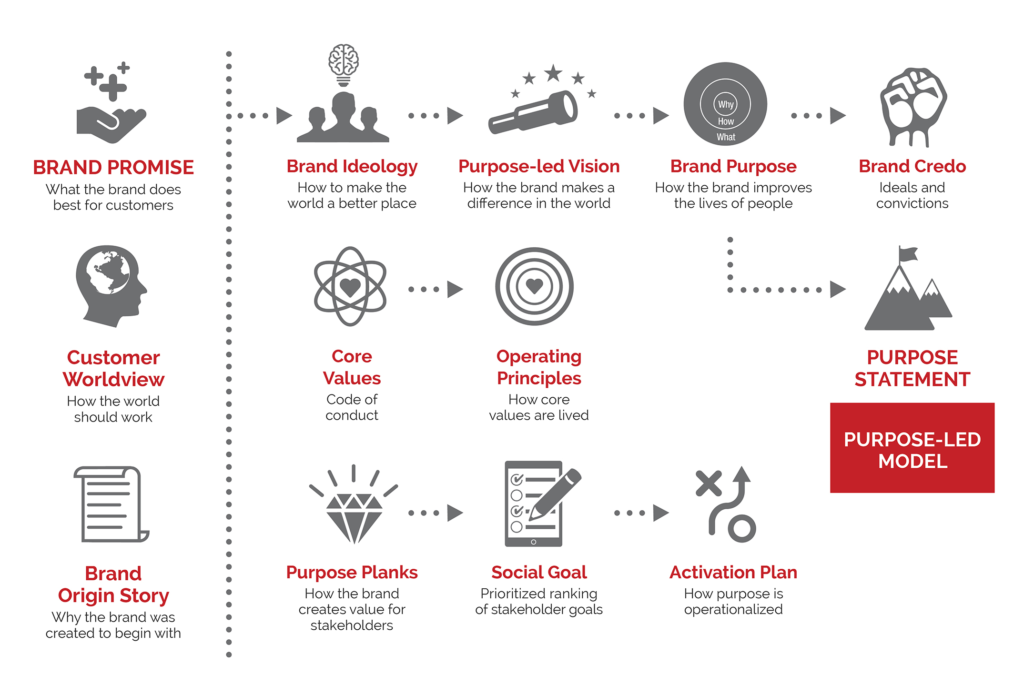

In arriving at the right purpose statement, there are four “purpose planks” to consider, all of which need to be thematically linked through a higher order expression of intent – how the company plans to make the world a better place.

The first and most important purpose plank is Customer Value: How the company is uniquely positioned to serve the needs of customers, now and in the future. What does the company do best? What does it want to be famous for, not just today, but far down the road? These are tougher questions than they appear because value creation is a constantly shifting equation: What someone values today may not be the same tomorrow. Clues may be found in the company’s origin story – why it was founded in the first place.

The definition of value marks the playing field where the company is best positioned to win. From there, a cascading set of questions: What are the core values and beliefs of our best customers? What kind of world would they like to see? What gives meaning to their lives? The answers can frame the discussion around the next plank which is Social Progress: How the company can be “a force for good” by helping solve systemic global challenges like climate change, poverty, racial injustice, and the like. The non-profit group JUST Capital, which tracks and measures the social performance of companies, offers a scorecard which can be used as a starting template.

The next couple of planks are closely related. Community Development covers local relationship building – like infrastructure upgrades, help for the disadvantaged, or sponsorship of cultural and recreational activity – which might otherwise be left to government to fund. And then you have Responsible Citizenship: acting with integrity, treating employees fairly, respecting the law (even if it’s a constraint on profit-making), and proactively seeking consensus amongst everyone who has a stake in the outcome.

That last bit may be hardest of all, given the acrimonious clashes of the past with organized labour, consumer rights groups and save-the-world movements. But it’s called stakeholder capitalism for a reason: social harmony can only be achieved through compromise and reciprocity. Making extortionist threats to kill job creation is no longer a socially acceptable bargaining strategy.

The one saving grace of this past year is that it has given progressive businesses an excuse to put the idea of shareholder primacy behind them once and for all – to move on to playing a more constructive role in society as opposed to constantly appeasing shareholders. Everyone has witnessed first-hand how fragile society becomes when the privileged take advantage of the underprivileged – when society splits into the haves and the have-nots. Building a fairer society that rewards all stakeholders will restore trust in business. But that depends on business being more generous in spirit. As Virgin owner Richard Branson says, “The brands that will thrive in the coming years are the ones that have a purpose beyond profit”. Now companies just need to find the right balance between purpose and profits.

1. In 2020 493 people joined the Forbes list of new billionaires.

2. See GoodJobsFirst.org, “Violation Tracker”

3. Scott Galloway, “The Great Grift”, January 2021

4. Fortune Magazine, “Trust and Consequences”, April/May 2021

Stephen Shaw is the chief strategy officer of Kenna, a marketing solutions provider specializing in delivering more unified customer experiences. He is also the host of a monthly podcast called Customer First Thinking. Stephen can be reached via e-mail at sshaw@kenna.